Author: ..

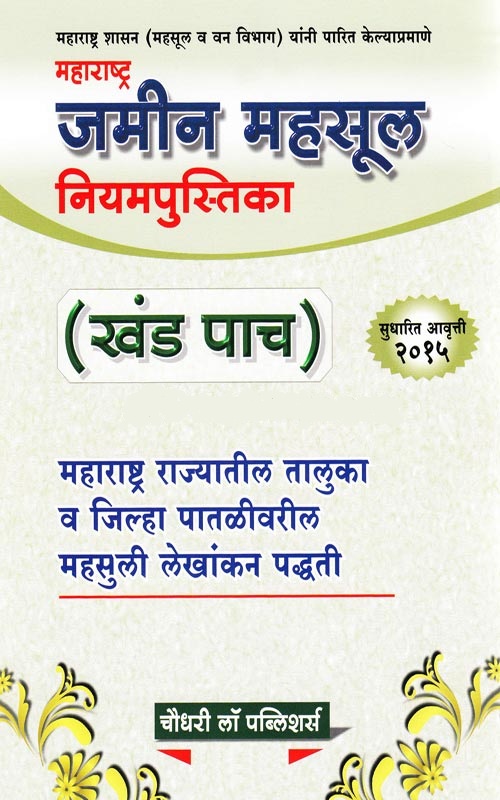

Publication: Chaudhari Law Publisher

Category: कायदेविषयक

Out of stock

Out of stock

- Standard delivery within 4-5 working days for Maharashtra.

- Standard delivery within 8-10 working days for locations outside Maharashtra.

Stock Availability- The availability of books depends on current stock levels. You will be notified if a selected book is out of stock.

Pricing Policy- Prices may vary based on the edition of the book.